Before you get started

This guide is for existing customers who have an unlicensed refund fuel tax account (either aircraft, motor, or special fuel) and want to file a refund claim with License Express.

Filing a refund involves reporting the following transactions about your aircraft, motor, and special, fuel usage:

- Monthly fuel purchases

- Gallons used

- Equipment(s)

Here are the fuel types that you will be reporting your usage information about in this refund:

| Fuel type | Description |

|---|---|

| Motor fuel | Any liquids commonly or commercially known, produced, exchanged, or sold as gasoline or defined as gasoline in statute. Ethanol and ethanol blends are included in this category. Reference: RCW 82.38 and WAC 308.77 |

| Special fuel | Any liquids commonly or commercially known, produced, exchanged, sold, or used as fuel in diesel engines. Biodiesel, biodiesel blends, and renewable diesel are included in this category. Reference: RCW 82.38 and WAC 308.77 |

| Aircraft fuel | Any liquids commonly or commercially known, produced, exchanged, sold, or used as fuel in aircraft. Jet and aviation fuel are included in this category. Reference: RCW 82.42 and WAC 308.77 / 308.78 |

Learn more about fuel tax refunds and credits.

If you previously used Taxpayer Access Point (TAP) to manage your account and complete other transactions, these guides will teach you how to set up a License Express account:

- How to set up a License Express account for your business

- How to set up a License Express account as a service agent

If you have never used TAP to manage your account, you can learn how to register with License Express using this guide:

If you’re a service agent acting on behalf of a fuel tax customer, you can follow the same instructions as the taxpayer.

Gather the required information

To file a fuel tax refund in your License Express account, you will need:

- Invoice/Receipts

- Equipment list

- IFTA PTO (if applicable)

- WA PTO (if applicable)

- Bill of Lading (if applicable)

- Boat/Vessel registration (if applicable)

- Tribe vessel registration and ID card (if applicable)

- Sale records (if applicable)

- Beginning and Ending inventory (if applicable)

You can enter invoice/receipt information directly into License Express, or you can use a tax return template (Excel spreadsheet) specific to your type of unlicensed refunds fuel tax account and upload this file as an attachment to License Express.

Submitting an unlicensed refund claim using a template

1. To use a template to submit your fuel tax return, choose a template based on the type of fuel tax account you have:

- Motor fuel: gas refund claim template

- Special fuel: diesel refund claim template

- Aircraft fuel: aviation gas and jet fuel refund claim template

2. When the template file downloads into your web browser, open it and save a copy so that you can enter the required information from your invoices/receipts. Make sure to save the template as xls or xlsx versions. Other excel versions will give an error when trying to upload the template.

Fuel tax rates

Fuel tax rate tables include the average cost of fuel and the various tax rates used for calculating refunds. These rates are updated in January and July of the current year. You must submit a separate claim for each period with a different rate. See current and previous fuel tax rate tables.

Records you must keep

Keep the following records on file for at least 5 years from the date you bought the fuel:

- All fuel receipts

- Documentation of all refundable and nonrefundable gallons of fuel used

- Documentation of the type of equipment used for refundable fuel (examples include boats, tractors, power saws, etc.)

- Fuel inventory readings in bulk storage

- Detailed fuel records for all withdrawals from bulk storage

- On-highway and off-highway mileage records for each licensed vehicle

Filing a fuel tax refund claim

Follow the steps below to help you file a fuel tax refund claim for your business or your individual account. These steps will guide you through motor, special, and aircraft fuel accounts.

Filing a fuel tax refund claim

Follow the steps below to help you file a fuel tax refund claim for your business or your individual account. These steps will guide you through motor, special, and aircraft fuel accounts.

At any time, you may choose the “Save Draft” button to save your progress and return to this filing process in the future.

1. From your License Express dashboard, within the “Account” screen for your motor, special, or aircraft unlicensed refund account, choose “File a New Refund Claim.”

2. Read over the “Introduction” screen to see what is required and what is needed to that specific account type. Different accounts will have a few different requirements. Choose the “Next” button.

3. Under “Period Information” screen, select the beginning period and ending period that you are wanting to claim from the dropdown menu. Choose the “Next” button.

4. Under the “Rate Selection” screen, indicate whether you would like to file as average or actual. Choose the “Next” button.

Note: Aircraft will not have this option.

5. At this stage, you can choose to “Import” your invoices and/or WA PTO from an excel file.

- If “Yes,” an “Upload Return” button will appear. Choose the “Upload Return” button and select your refund claim template from your desktop. Choose the “Next” button.

- If “No,” choose the “Next” button.

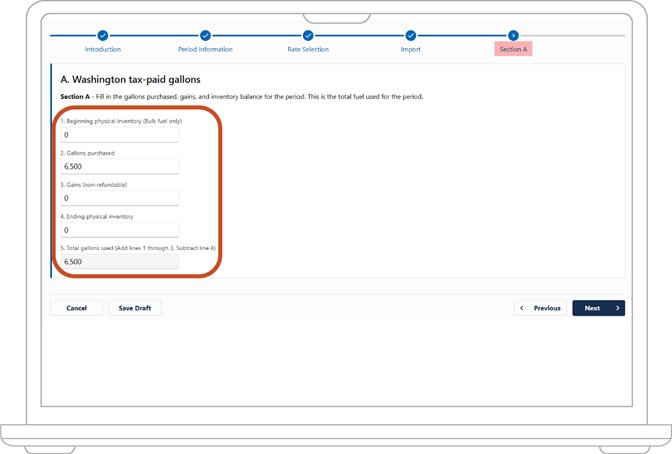

6. “Section A” is for the Washington tax-paid gallons. Complete the following sections (lines 1-5):

- Beginning physical inventory (if applicable)

- Gallons purchased

- Gains (if applicable)

- Ending physical inventory (if applicable)

- Total gallons used will auto fill

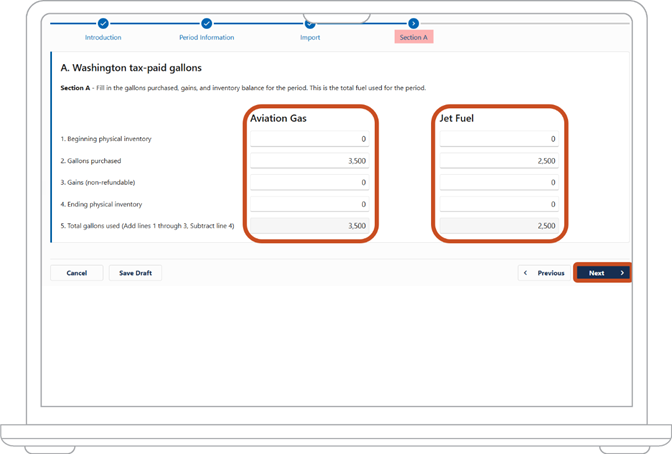

- Aircraft fuel accounts will have the same required fields. However, it must be filled out for both “Aviation Gas” and “Jet Fuel” and must also look different from motor and special fuel accounts.

- Choose the “Next” button.

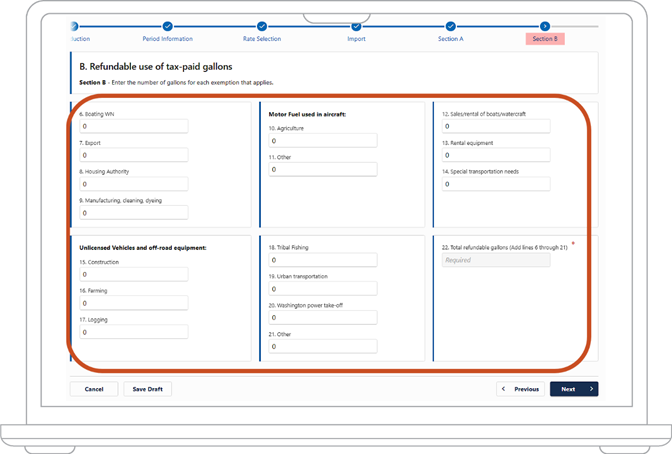

7. The “Section B” screen will depend on the account type you are requesting a refund for. Each account type will have a few different refund exemptions. Enter the gallons used for each exemption you are requesting a refund for:

- Motor fuel will have exemption lines 6-22.

- Special fuel will have exemption lines 6-28.

- Aircraft fuel will have exemption lines 6-13.

- Choose the “Next” button.

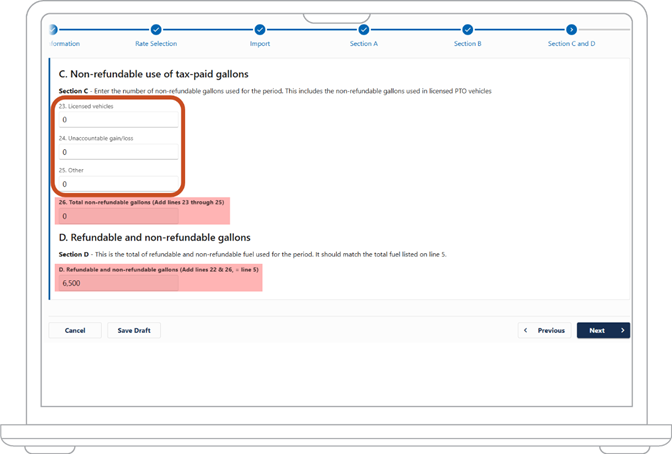

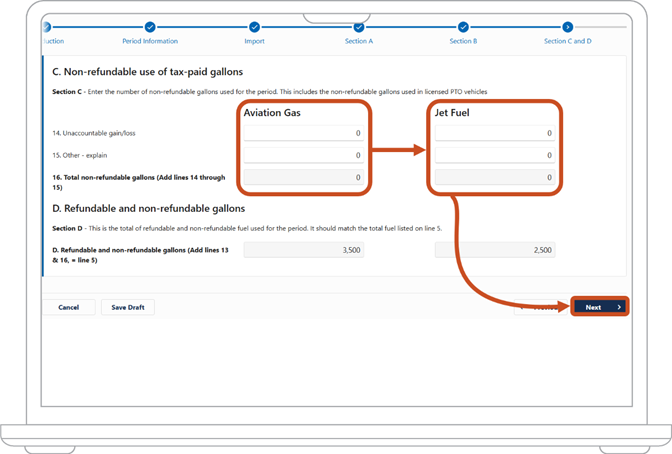

8. “Sections C and D” are or the non-refundable use of tax-paid gallons. Complete the following sections, if applicable:

- Licensed vehicles

- Unaccountable gain/loss

- Other

Note: Total non-refundable gallons and Section D will automatically be filled out.

- Aircraft fuel accounts will have similar required fields. However, it must be filled out for both “Aviation Gas” and “Jet Fuel” and must also look different from motor and special fuel accounts.

- Choose the “Next” button.

9. The next step depends on how you chose to file your refund claim in step 4.

- If you filed as average, jump to step 10.

- If you filed as actuals, jump to step 11.

Filed as average

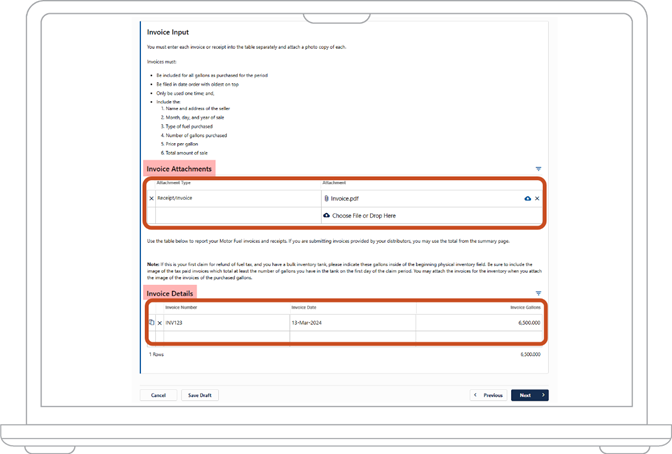

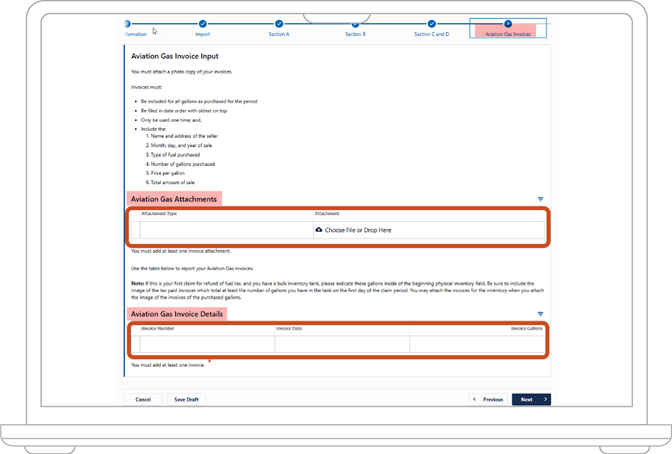

10. On the “Invoices” screen, you must input all invoices separately under the “Invoice Details” section. Then attach all invoices/receipts under the “Invoice Attachments” section.

- Motor and special fuel

- Aircraft fuel will have an “Aviation Gas Invoices” tab and a “Jet Fuel Invoices” tab.

- Choose the “Next” button. Jump to step 12.

Filed as actuals

11. On the “Actuals” tab, you will need to input all invoices separately under the “Actual Details” section. Then attach all invoices/receipts under the “Actual Attachments” section. If you have bulk fuel inventory, you must note it in the “Actual Details” section as well. Choose the “Next” button.

Continue the filing process

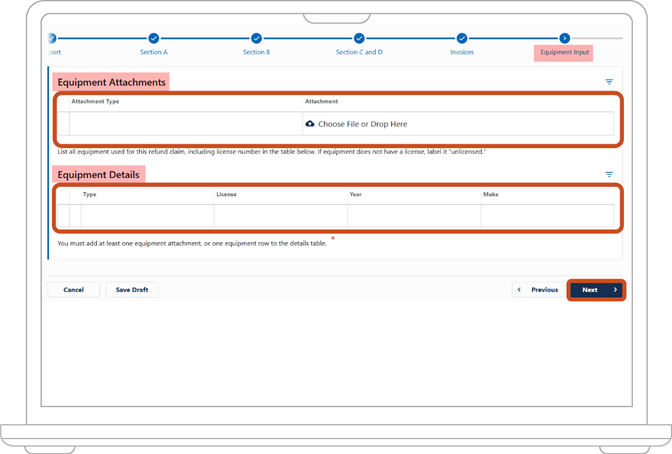

12. The following screen depends on what you requested a refund for:

- Boating refunds will have the “Vessel Input” tab. Enter your boating information and/or attach your boat registration.

- Export refunds will have the “Export” tab. Enter your export information and attach your export documents.

- WA PTO and /or IFTA PTO refunds will have the PTO tab. Enter your PTO details for each vehicle on separate lines.

- All other requests will have the “Equipment Input” tab. You will need to either attach your equipment list and/or list all equipment used under the “Equipment Details” section.

- Choose the “Next” button.

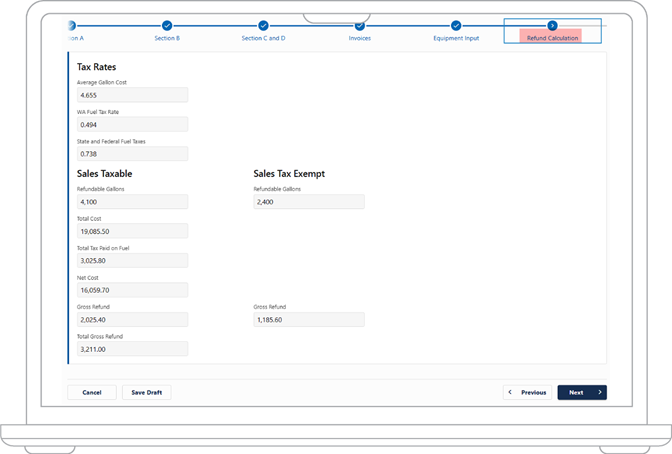

13. The “Refund Calculation” tab will display next. Look over the calculation.

- Motor and special fuel claims.

- Aircraft fuel claims. Enter the following information:

- Preparer’s Name

- Preparer’s Telephone number

- Comments (if applicable)

- Check the certify box

- Choose the “Next” button and jump to step 16.

14. The “Refund Deductions” tab will display next. Look over the deductions then choose the “Next” button.

15. On the “Refund Summary” screen, enter the following information:

- Preparer’s Name

- Preparer’s Telephone number

- Comments (if applicable)

- Check the certification box

- Choose the “Next” button

16. On the “Refund Options” screen, select how you would like to receive your refund:

- If you’d like to receive a “Check,” choose the “Submit” button.

- If you’d like to receive a “Direct Deposit,” enter your banking information then choose the "Submit” button.

17. On the “Confirmation” screen, you'll see a confirmation number. Keep this number for your records. You can either choose the “Continue” button to go back to your dashboard or the “Print” button to print your confirmation page.

After you file your fuel tax refund claim

We’ll verify the information you provided. We may contact you with questions at any time while we work to verify your information. Watch your email inbox or your mailbox, depending on the method of communication you choose.

If we don’t approve your refund, we’ll tell you why. You can try again once you have the correct information or documents.